1С

Мобильная бухгалтерия

Description of 1С: Мобильная бухгалтерия

Mobile accounting for individual entrepreneurs, LLC organizations and self-employed people.

Mobile accounting completely FREE:

- Calculate and remind about taxes: simplified tax system, insurance premiums and patent, tax for self-employed

- Prepare payments under the Unified Tax Code to replenish the Single Tax Account

- Prepares and sends payments directly to the bank

- Will remind you about the delivery and fill out the simplified taxation system declarations 2023, 2024

- Reminds you about the delivery and fills out the Notification according to the simplified tax system

- Prepare a Notice to reduce the amount of the patent

- Send the client an Invoice, Act or Invoice, Invoice or UPD, Power of Attorney

Mobile accounting is suitable:

• For an entrepreneur on the simplified tax system "Income", the simplified tax system "Income minus expenses" with any rate: 0%, 4%, 6% and 15% and tax holidays, Patent

• Organizations on the simplified tax system (6% and 15%) and the general regime (Income tax and VAT)*

• Self-employed (professional income tax payer registered in the "My Tax" service)

For entrepreneurs:

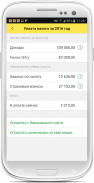

• Calculate the amounts of fixed insurance premiums for 2023, 2024;

• Calculate the amount of tax and advance payments paid in connection with the application of the simplified taxation system (STS) for 2023, 2024;

• Pay taxes and fees for 2023, 2024;

• Prepare a Book of Income and Expenses;

• Prepare and submit the simplified tax system declaration for 2023, 2024;

• Submit a zero declaration of the simplified tax system for 2023, 2024;

• Reminds you of the approaching deadline for paying taxes, paying salaries or submitting reports.

For organizations*:

• Calculate the amount of tax and advance payments for VAT;

• Prepare a set of financial statements for small businesses;

• And much more...

For self-employed people - integration with the "My Tax" service:

• Registration of income and receipt of electronic checks

• Obtaining certificates

• Receiving tax receipts

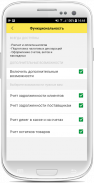

For all:

• Invoices, with the ability to insert your logo, signature and seal;

• Acts, invoices TORG-12, UPD and sales receipts

• Act of reconciliation of settlements with the counterparty

• Power of attorney

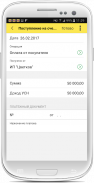

• Accounting for money, incoming and outgoing payments

• Accounting for settlements with buyers and suppliers

• Accounting for remaining goods

• Receive payment from clients by card through Yukassa

Integration with 1C:

• Service 1C:Kassa

• Submitting reports via the Internet (1C-Reporting)*

• Access to the application from a computer through the 1C:BusinessStart service*

Integration with banks:

• At the moment, exchange with Sberbank online, Avangard, Tochka, Binbank (E-plat system), Tinkoff, Modulbank, Uralsib, UBRR, bank "SAINT PETERSBURG", Blank bank is supported

• Downloading a bank statement via Yandex.Disk allows you to download information about receipts to your current account from almost any bank: Alfa Bank, VTB and many others

Always up-to-date information:

• Checking changes in tax details

• Filling in information about counterparties using TIN*

• Entering an address using a classifier, the same one used by the tax office

• Current classifiers of tax authorities and banks

Online cash desks:

• Loading sales from the 1C:Kassa complex (online cash register)

Backup:

• Mobile application data is saved in cloud storage, from where it can be restored when changing phone (available after registration)

* Subscription to the 1C:BusinessStart service is required

The application was created on the mobile platform 1C Enterprise 8.3